Related Questions

Q45: Judy Ring purchased a watch with a

Q49: Mike's condo has a market value of

Q55: Calculate (A) actual sales and (B) sales

Q57: Calculate assessed value:

Given: property tax $6,100; 26

Q59: Jen Rich bought a new Toyota for

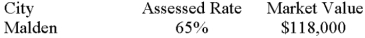

Q61: Calculate the assessed valuation: Q62: Calculate the assessed valuation: Q80: The home of Al Gard is assessed Q93: Bonnie Flow pays a property tax of Q100: Calculate assessed value:![]()

![]()

Given: property tax $5,200; 32

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents