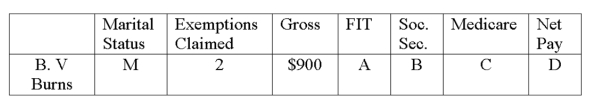

Calculate the net pay. The balance before this weekly payroll is $90 below maximum as related to cumulative earnings in calculating Social Security. Assume a tax rate of 6.2% for Social Security on $110,100 and 1.45% for Medicare:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Alvin Shore sells jewelry at Ross Jewelers.

Q54: FUTA tax is paid:

A)By an employee

B)By the

Q61: Janet Smooth pays her workers $175, $465,

Q61: Jim Jones, owner of Freed Company, has

Q63: Andrew Buckner earns $1,680 per week. He

Q66: Robin Small pays her three workers $180,

Q67: Jill is $200 from reaching maximum base

Q68: Molly Flynn, an accountant at Coor Company,

Q102: Robert Bryan, Jr., earns $400 per week

Q106: Jim Dashinger is a salesman who receives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents