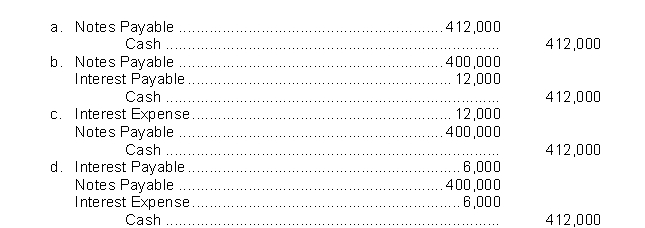

West County Bank agrees to lend Drake Builders Company $400,000 on January 1.Drake Builders Company signs a $400,000, 6%, 6-month note.What entry will Drake Builders Company make to pay off the note and interest at maturity assuming that interest has been accrued to June 30?

Correct Answer:

Verified

Q52: Interest expense on an interest-bearing note is

A)

Q75: Sales taxes collected by a retailer are

Q80: Liabilities are classified as current or long-term

Q83: On October 1, Sam's Painting Service borrows

Q84: A company receives $348, of which $28

Q88: The interest charged on a $350,000 note

Q89: The interest charged on a $300,000 note

Q90: The interest charged on a $90,000 note

Q92: A retail store credited the Sales Revenue

Q100: The amount of sales tax collected by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents