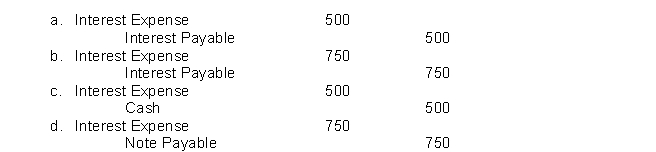

A gift shop signs a three-month note payable to help finance increases in inventory for the Christmas shopping season.The note is signed on November 1 in the amount of $50,000 with annual interest of 6%.What is the adjusting entry to be made on December 31 for the interest expense accrued to that date, if no entries have been made previously for the interest?

Correct Answer:

Verified

Q189: Mary Richardo has performed $500 of CPA

Q190: Kingman Consulting uses the cash basis of

Q191: The accounts of a business, before an

Q192: DeNova Real Estate signed a four-month note

Q193: Amos Real Estate signed a four-month note

Q195: Raxon Company borrowed $50,000 from the bank

Q196: On November 1, 2021, Weller Industries, which

Q197: Brokaw Industries signs a $40,000, 9%, 6-month

Q198: Nacron Company borrowed $15,000 from the bank

Q199: Baden Industries borrows $20,000 at 7% annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents