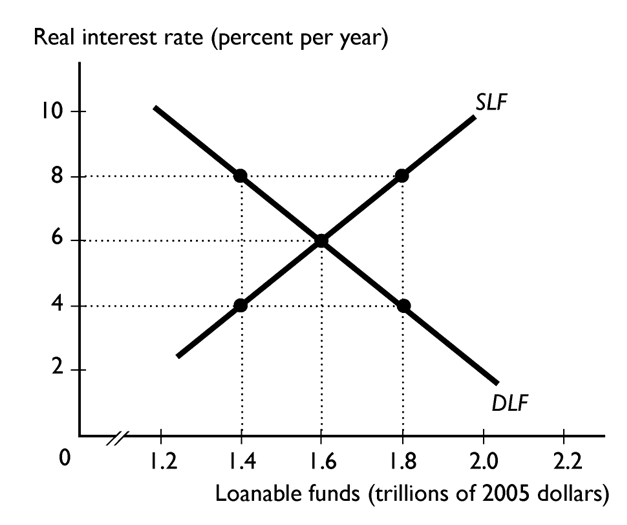

The figure above shows the loanable funds market.

-At an interest rate of

A) 8 percent the quantity of loanable funds supplied is $14 trillion.

B) 6 percent savers will exit the market because the reward to saving is too low.

C) 4 percent there is a surplus of loanable funds.

D) 8 percent the quantity demanded of loanable funds is $18 trillion.

E) 4 percent there is a shortage of loanable funds.

Correct Answer:

Verified

Q45: Which of the following occurs if the

Q46: If a surplus of loanable funds exists

Q47: The demand for loanable funds curve slopes

Q48: Net investment is

A)the same as depreciation.

B)gross investment

Q49: U.S. capital at the end of 2012

Q51: Bill's Lawn service starts the year with

Q52: Other things remaining the same, the ----------------------------------------the

Q53: Suppose the government's budget deficit increases by

Q54: Lulu purchased a security that promises to

Q55: If there is no Ricardo-Barro effect, an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents