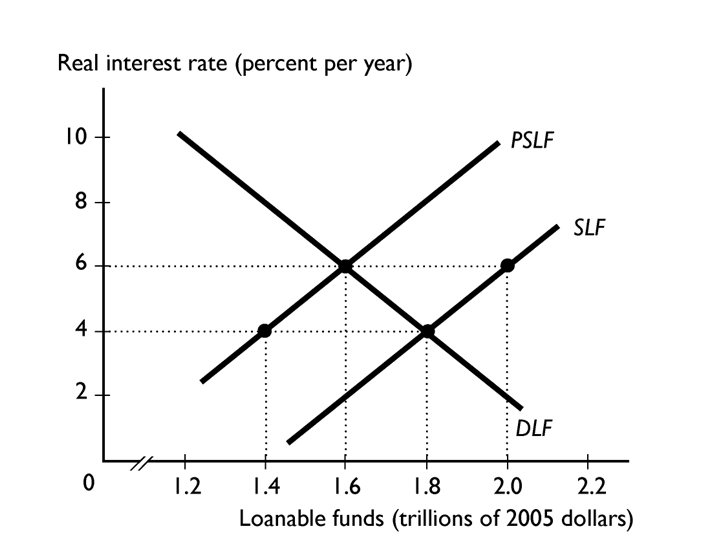

In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve.

- If there is no ricardo-Barro effect and the government now runs a balanced budget, the

A) there is shortage of investment funds of $0.4 trillion.

B) interest rate will increase from 4 percent to 6 percent.

C) there is a surplus of investment funds and the interest rate falls to 4 percent.

D) equilibrium interest rate is 4 percent and investment is $1.8 trillion.

E) equilibrium interest rate is 6 percent and investment is $1.6 trillion.

Correct Answer:

Verified

Q109: Wealth is to --------------------as capital stock is

Q110: An increase in wealth--------------------saving supply and the

Q111: At the current interest rate, the quantity

Q112: --------------------reflects a use of loanable funds while--------------------reflects

Q113: Technological change can increase the demand for

Q115: The tendency for higher government budget deficits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents