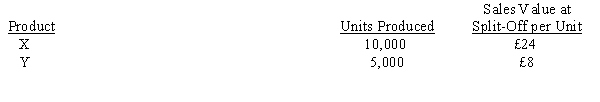

Carey Ltd. manufactures Products X and Y from a joint process. Joint product costs were £60,000 during the month of December. Additional information is as follows:  What is the amount of joint product costs to be allocated to Product X during December using the sales-value-at-split-off method?

What is the amount of joint product costs to be allocated to Product X during December using the sales-value-at-split-off method?

A) £20,000

B) £45,000

C) £51,429

D) £40,000

Correct Answer:

Verified

Q6: Amos, SA., manufactures products A and B

Q6: Which of the following would generally be

Q7: The sales-value-at-split-off method allocates joint production costs

Q8: _ are products with substantial value which

Q9: Which of the following is a by-product

Q13: Carey Ltd. manufactures products X and Y

Q14: Joint costs are

A)separable.

B)allocated on the basis of

Q15: Refer to Figure 6-3. What is the

Q19: The _ is where products become distinguishable

Q21: Which joint cost allocation method is described

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents