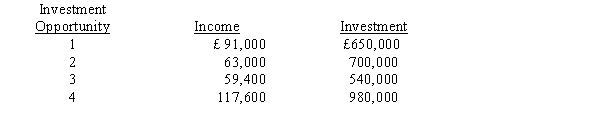

The manager of the recently formed Oak Division of Parkes, Incorporated, is evaluating the following four investment opportunities available to the division. Parkes, Incorporated, requires a minimum return of 10 per cent.  Required:

Required:

a.

Calculate the return on investment (ROI) for each investment opportunity.

b.

If only one investment opportunity can be funded and the division is evaluated based on ROI, which investment opportunity would be accepted?

c.

If Parkes, Incorporated, can fund all of the projects and wishes to achieve the best possible performance, which investments would be accepted?

Correct Answer:

Verified

Q38: Which of the following is a disadvantage

Q42: TotToys Ltd. recently made £2,000,000 of capital

Q43: Correll Company has two divisions, A and

Q44: Figure 19-4

Beta Division had the following

Q44: Compare and contrast return on investment (ROI)

Q45: The following results for the current year

Q46: O'Neil Company requires a return on capital

Q47: Figure 19-4

Beta Division had the following

Q47: Stevens Company has two divisions that report

Q51: The following information pertains to the three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents