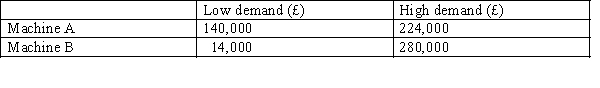

The Tamesek Company is considering purchasing one of two mutually exclusive machines. Machine A is most suited to low levels of demand whereas machine B is suited to high-level demand. There are only two possible outcomes and each has the same level of probability. The estimated profits for each demand level are as follows:  There is a possibility of employing a firm of management consultants who would be able to provide a perfect prediction of actual demand. What is the maximum amount that the company would be prepared to pay for the additional information?

There is a possibility of employing a firm of management consultants who would be able to provide a perfect prediction of actual demand. What is the maximum amount that the company would be prepared to pay for the additional information?

A) £98,000

B) £14,000

C) £70,000

D) None of the above

Correct Answer:

Verified

Q3: The decision rule under the maximin criterion

Q14: Under what circumstances can risk reduction NOT

Q19: Figure 12-1

Joe Bloggs is considering the following

Q20: Figure 12-1

Joe Bloggs is considering the following

Q21: Figure 12-3

The Lee Company must choose between

Q22: Figure 12-3

The Lee Company must choose between

Q24: Jackson is considering launching a new product

Q27: Figure 12-3

The Lee Company must choose between

Q28: Figure 12-3

The Lee Company must choose between

Q29: Figure 12-3

The Lee Company must choose between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents