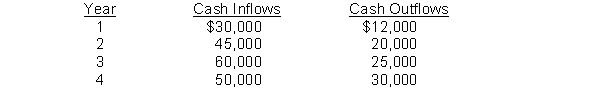

Bradshaw Inc. is contemplating a capital investment of $88,000. The cash flows over the project's four years are:

Expected Annual Expected Annual

The cash payback period is

A) 3.59 years.

B) 3.50 years.

C) 2.37 years.

D) 3.20 years.

Correct Answer:

Verified

Q41: The cash payback technique

A) considers cash flows

Q46: Jordan Company is considering the purchase of

Q46: A disadvantage of the cash payback technique

Q49: Nance Company is considering buying a machine

Q51: Bark Company is considering buying a machine

Q52: When using the cash payback technique, the

Q55: The discount rate is referred to by

Q56: If an asset costs $240,000 and is

Q57: Which of the following does not consider

Q59: If project A has a lower payback

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents