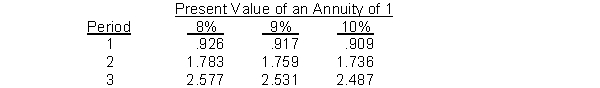

Use the following table,  A company has a minimum required rate of return of 8%. It is considering investing in a project that costs $379,650 and is expected to generate cash inflows of $150,000 each year for three years. The approximate internal rate of return on this project is

A company has a minimum required rate of return of 8%. It is considering investing in a project that costs $379,650 and is expected to generate cash inflows of $150,000 each year for three years. The approximate internal rate of return on this project is

A) 8%.

B) 9%.

C) 10%.

D) The IRR on this project cannot be approximated.

Correct Answer:

Verified

Q103: If a project has a zero net

Q115: If a project has a profitability index

Q118: The internal rate of return is the

Q121: A company projects an increase in net

Q122: A company is considering purchasing a machine

Q123: If a 3-year capital project costing $77,310

Q126: Which of the following will cause the

Q129: If the internal rate of return is

Q131: If a project costing $80,000 has a

Q132: The internal rate of return factor is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents