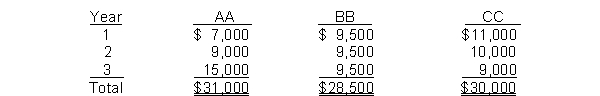

Cepeda Manufacturing Company is considering three new projects, each requiring an equipment investment of $22,000. Each project will last for 3 years and produce the following cash inflows.

The equipment's salvage value is zero. Cepeda uses straight-line depreciation. Cepeda will not accept any project with a payback period over 2 years. Cepeda's minimum required rate of return is 12%.

Instructions

(a) Compute each project's payback period, indicating the most desirable project and the least desirable project using this method. (Round to two decimals.)

(b) Compute the net present value of each project. Does your evaluation change? (Round to nearest dollar.)

Correct Answer:

Verified

$22,000 - $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q164: KSU Corp. is considering purchasing one of

Q165: Sophie's Pet Shop is considering the purchase

Q166: Yappy Company is considering a capital investment

Q167: Ace Corporation recently purchased a new machine

Q169: Laramie Service Center just purchased an automobile

Q171: Santana Company is considering investing in a

Q172: Under the net present value method, the

Q173: Shilling Corp. is thinking about opening a

Q209: The two discounted cash flow techniques used

Q211: The technique which identifies the time period

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents