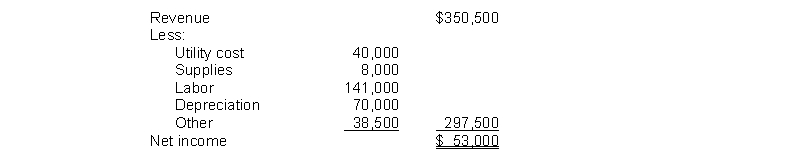

Tom Bat became a baseball enthusiast at a very early age. All of his baseball experience has provided him valuable knowledge of the sport, and he is thinking about going into the batting cage business. He estimates the construction of a state-of-the-art building and the purchase of necessary equipment will cost $840,000. Both the facility and the equipment will be depreciated over 12 years using the straight-line method and are expected to have zero salvage values. His required rate of return is 9% (present value factor of 7.1607). Estimated annual net income and cash flows are as follows:

Instructions

For this investment, calculate:

(a) The net present value.

(b) The internal rate of return.

(c) The cash payback period.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q173: Shilling Corp. is thinking about opening a

Q174: Top Growth Farms, a farming cooperative, is

Q175: Savanna Company is considering two capital investment

Q176: Vista Company is considering two new projects,

Q177: For purposes of capital budgeting, estimated _

Q179: Gantner Company is considering a capital investment

Q180: Mimi Company is considering a capital investment

Q181: You are the general accountant for Word

Q183: Sam Stanton is on the capital budgeting

Q206: The internal rate of return method differs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents