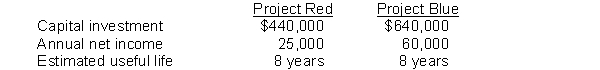

Savanna Company is considering two capital investment proposals. Relevant data on each project are as follows:

Depreciation is computed by the straight-line method with no salvage value. Savanna requires an 8% rate of return on all new investments. The present value of 1 for 8 periods at 8% is .540 and the present value of an annuity of 1 for 8 periods is 5.747.

Instructions

(a) Compute the cash payback period for each project.

(b) Compute the net present value for each project.

(c) Compute the annual rate of return for each project.

(d) Which project should Savanna select?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q171: Santana Company is considering investing in a

Q172: Under the net present value method, the

Q173: Shilling Corp. is thinking about opening a

Q174: Top Growth Farms, a farming cooperative, is

Q176: Vista Company is considering two new projects,

Q177: For purposes of capital budgeting, estimated _

Q178: Tom Bat became a baseball enthusiast at

Q179: Gantner Company is considering a capital investment

Q180: Mimi Company is considering a capital investment

Q209: The two discounted cash flow techniques used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents