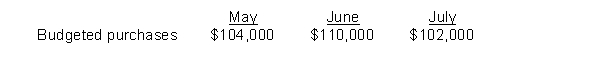

Plack Company budgeted the following information for 2013:

Cost of goods sold is 40% of sales. Accounts payable is used only for inventory acquisitions.

Plack purchases and pays for merchandise 60% in the month of acquisition and 40% in the following month.

Selling and administrative expenses are budgeted at $30,000 for May and are expected to increase 5% per month. They are paid during the month of acquisition. In addition, budgeted depreciation is $10,000 per month.

Income taxes are $38,400 for July and are paid in the month incurred.

Instructions

Compute the amount of budgeted cash disbursements for July.

Correct Answer:

Verified

Q168: Smoke, Inc. makes and sells buckets. Each

Q168: The beginning cash balance is $15000. Sales

Q169: Shep Company combines its operating expenses for

Q170: Beal, Inc. provided the following information:

Q171: Leaf Industries is preparing its master budget

Q172: Garver Industries has budgeted the following unit

Q175: The following facts are known:

Q176: The budget components for Park Company for

Q177: Benet Company has budgeted the following unit

Q186: Walt Bach Company has accumulated the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents