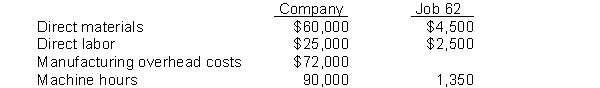

Graham Manufacturing is a small manufacturer that uses machine-hours as its activity base for assigned overhead costs to jobs. The company estimated the following amounts for 2017 for the company and for Job 62:

During 2017, the actual machine-hours totaled 95,000, and actual overhead costs were $71,000.

Instructions

(a) Compute the predetermined overhead rate.

(b) Compute the total manufacturing costs for Job 62.

(c) How much overhead is over or underapplied for the year for the company? State amount and whether it is over- or underapplied.

(d) If Graham Manufacturing sells Job 62 for $14,000, compute the gross profit.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q165: Job cost sheets for Howard Manufacturing are

Q166: Selected accounts of Kosar Manufacturing Company at

Q167: Garner Company begins operations on July 1,

Q168: A job cost sheet of Fugate Company

Q169: Finn Manufacturing Company uses a job order

Q171: Grant Marwick and Associates, a CPA firm,

Q172: Sardin Company begins the month of March

Q174: The following inventory information is available for

Q175: Manufacturing cost data for Dolan Company, which

Q176: Lando Company reported the following amounts for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents