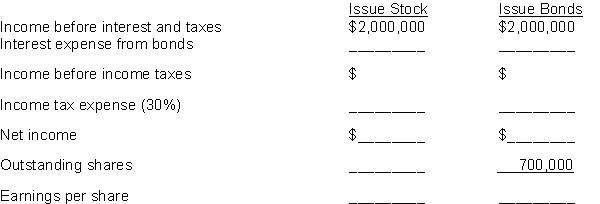

Layton Inc. is considering two alternatives to finance its construction of a new $5 million plant.

(a) Issuance of 500,000 shares of common stock at the market price of $10 per share.

(b) Issuance of $5 million, 9% bonds at par.

Instructions

Complete the following table.

Correct Answer:

Verified

Q214: On January 1, 2018, Frog Corporation issued

Q218: On January 1, 2017, Zappa Enterprises sold

Q219: Roxy Inc. issues a $1,500,000, 10%, 10-year

Q220: Fresh Corporation reports the following selected financial

Q222: Under IFRS, liabilities

A) must be legally enforceable

Q222: Howell Company has the following selected accounts

Q225: The debt to assets ratio is computed

Q233: When current liabilities are presented under IFRS,

Q248: Identify which of the following would be

Q255: Golf Pro Publications publishes a golf magazine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents