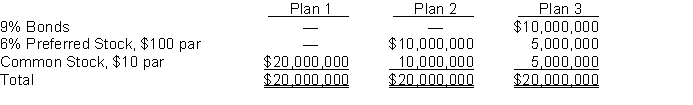

Three plans for financing a $20,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount and the income tax rate is estimated at 30%.

It is estimated that income before interest and taxes will be $5,000,000.

Instructions

Determine for each plan, the expected net income and the earnings per share on common stock.

Correct Answer:

Verified

Q182: If bonds are issued at face value

Q184: The terms of a bond issue are

Q194: Discount on Bonds Payable is _ (from)(to)

Q203: Liabilities are classified on the balance sheet

Q209: Sales taxes collected from customers are a

Q214: Obligations in written form are called _

Q264: Wellington Company had the following transactions involving

Q268: Flores Company publishes a monthly sports magazine,

Q287: The board of directors of Moore Corporation

Q298: Bonds that the issuing company can redeem

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents