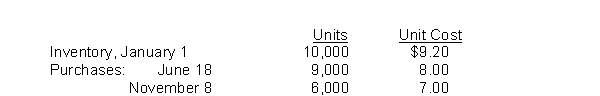

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. What is the difference in taxes if LIFO rather than FIFO is used?

A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. What is the difference in taxes if LIFO rather than FIFO is used?

A) $1,760 additional taxes

B) $992 additional taxes

C) $786 additional taxes

D) $992 tax savings

Correct Answer:

Verified

Q87: Moroni Industries has the following inventory information.

Q88: Priscilla has the following inventory information.

Q89: Romanoff Industries had the following inventory transactions

Q91: Netta Shutters has the following inventory information.

Q94: Netta Shutters has the following inventory information.

Q95: Netta Shutters has the following inventory information.

Q96: Priscilla has the following inventory information.

Q113: In periods of rising prices the inventory

Q116: If companies have identical inventoriable costs but

Q118: In a period of increasing prices which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents