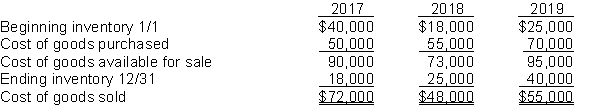

Baden's Hardware Store prepared the following analysis of cost of goods sold for the previous three years:

Net income for the years 2017, 2018, and 2019 was $70,000, $60,000, and $55,000, respectively. Since net income was consistently declining, Mr. Baden hired a new accountant to investigate the cause(s) for the declines.

The accountant determined the following:

1. Purchases of $25,000 were not recorded in 2017.

2. The 2017 December 31 inventory should have been $24,000.

3. The 2018 ending inventory included inventory costing $5,000 that was purchased FOB destination and in transit at year end.

4. The 2019 ending inventory did not include goods costing $4,000 that were shipped on December 29 to Sampson Plumbing Company, FOB shipping point. The goods were still in transit at the end of the year.

Instructions

Determine the correct net income for each year. (Show all computations.)

Correct Answer:

Verified

Q193: The following information is available for Heller

Q196: For each of the independent events listed

Q199: This information is available for Eaton's Photo

Q202: Wellington Company reported net income of $60,000

Q204: The _ method tracks the actual physical

Q214: The cost of goods purchased during a

Q226: Errors occasionally occur when physically counting inventory

Q228: The lower-of-cost-or-net realizable value basis of accounting

Q230: In a period of rising prices, the

Q231: _ is calculated as cost of goods

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents