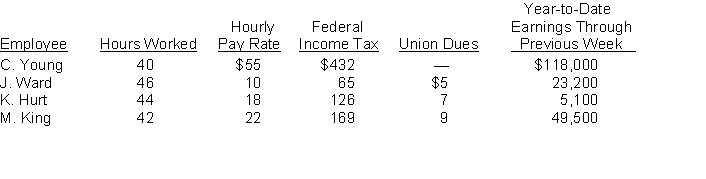

Assume that the payroll records of Erroll Oil Company provided the following information for the weekly payroll ended November 30, 2018.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

Correct Answer:

Verified

Q21: Changes in pay rates during employment should

Q22: Which of the following is not performed

Q23: Control over timekeeping does not include

A) having

Q25: Match the codes assigned to the following

Q25: An employee's payroll check is distributed by

Q28: Match the items below by entering the

Q31: Sam Geller had earned (accumulated) salary of

Q32: Banner Company had the following payroll data

Q106: Which of the following employees would likely

Q154: The tax that is paid equally by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents