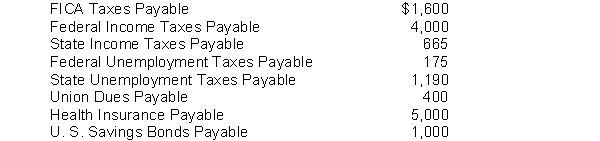

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Correct Answer:

Verified

Q21: Changes in pay rates during employment should

Q25: An employee's payroll check is distributed by

Q28: Match the items below by entering the

Q28: Ann Hech's regular hourly wage is $18

Q31: Sam Geller had earned (accumulated) salary of

Q32: Banner Company had the following payroll data

Q35: Warren Company's payroll for the week ending

Q37: Diane Lane earns a salary of $9,900

Q37: Match the items below

Q38: Match the procedures listed below with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents