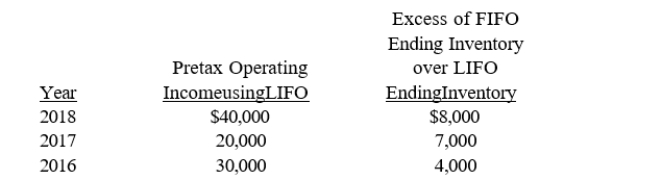

Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2018. The following data were available:  The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

The income tax rate is 35%. The company began operations on January 1, 2016, and has paid no dividends since inception.

Required:

Answer the following questions relating to the 2017-2018 comparative financial statements.

a. What is net income for 2018?

b. What is restated net income for 2017?

c. Prepare the 2017 statement of retained earnings as it would appear in the comparative

2017-2018 financial statements.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: On January 1, Year 1, the

Q109: Meagan Co. has the following errors on

Q110: When is a retrospective adjustment considered impractical

Q111: Several errors are listed below.

Q112: The 2016 and 2017 financial statements for

Q114: What are the three type of accounting

Q115: According to GAAP how should items be

Q116: Shelley Construction began operations in 2016

Q117: Provide three examples of changes in principle.

Q118: What are the two methods for reporting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents