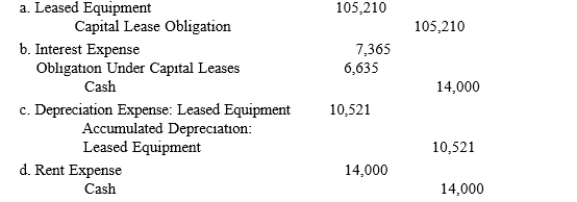

On January 1, 2016, Denise Company signed a lease agreement requiring ten annual payments of $14,000, beginning December 31, 2016. The agreement was classified as a capital lease. When reviewing Denise's accounting records, which of the following journal entries would not be expected?

Correct Answer:

Verified

Q10: For a lease that contains a bargain

Q16: If a lease is classified as a

Q22: A lease that transfers substantially all the

Q23: If a lease is structured so that

Q24: On January 1, 2016, Watson Company signed

Q25: Which of the following cash flows is

Q27: If all of the following are provided

Q29: A lessee computes the present value of

Q30: When a lessee makes periodic cash payments

Q31: Exhibit 20-1

On January 1, 2016, Pearson Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents