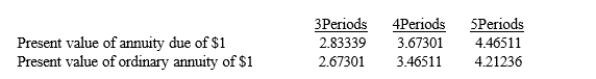

On January 1, 2016, Madison Company signed a four-year lease requiring annual payments of $15,000 with the first payment due on January 1, 2016. The fair value of the equipment leased was $50,000. Madison's incremental borrowing rate was 6%. Actuarial information for 6% follows:

Assuming the lease qualifies as a capital lease, what amount should be recorded as leased equipment under capital leases on January 1, 2016 rounded to the nearest dollar) ?

A) $48,185

B) $50,000

C) $51,977

D) $55,095

Correct Answer:

Verified

Q27: A capital lease should be recorded in

Q31: When a lessee makes periodic cash payments

Q43: The Roger Company leased a machine at

Q44: When a lessee makes periodic cash payments

Q44: Exhibit 20-2

On January 1, 2016, Mary Company

Q45: Exhibit 20-2

On January 1, 2016, Mary Company

Q48: Exhibit 20-2

On January 1, 2016, Mary Company

Q49: On January 3, 2016, the Walters Corporation

Q50: On January 1, 2016, Mark Company leased

Q60: Which of the following items would not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents