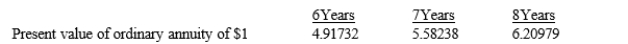

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:

What is the annual lease payment to be collected by Davis?

A) $8,571.43

B) $9,115.25

C) $10,139.72

D) $11,516.78

Correct Answer:

Verified

Q51: Which of the following is not a

Q61: Which of the following statements is true

Q69: Which of the following is a required

Q70: On January 1, 2016, Stephen Corp., a

Q71: On January 1, 2016, Stacie signed a

Q72: A lessee reports noncash investing and financing

Q73: In a sales-type lease

A) sales revenue ignores

Q75: On January 1, 2016, Rhyme Co. leased

Q76: A lease must be treated as a

Q79: When a lessor receives cash on an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents