Exhibit 20-5

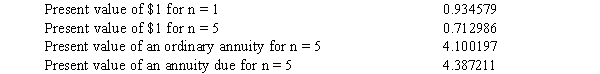

The Baltimore, Inc. entered into a five-year lease with the Waugh Chapel Company on January 1, 2016. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2016. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2020. The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7%

-Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, how much gross profit will Baltimore record at the inception of the lease?

A) $7,505

B) $14,680

C) $16,061

D) $23,236

Correct Answer:

Verified

Q75: A lessor enters into a sales-type lease.Which

Q92: Exhibit 20-5

The Baltimore, Inc. entered into a

Q93: A six-year operating lease requires annual rent

Q94: Which of the following items should be

Q96: Exhibit 20-3

On January 1, 2016, Quinn Company

Q98: On January 1, 2016, Luke, Inc. leased

Q99: Which of the following amortization policies is

Q100: Which of the following statements concerning direct

Q101: A sales-type lease results in a manufacturer's

Q102: On January 1, 2001, Wishful Thinking, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents