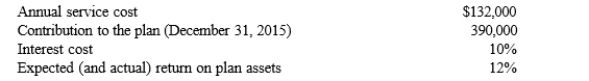

John Company adopted a defined benefit pension plan on January 1, 2015, and prior service credit was granted to employees. The present value of that prior service obligation as of January 1, 2015 was $1,400,000 and is being amortized by the straight-line method over the remaining 20-year service life of the company's active employees. Additional information relating to the company's pension plan for 2015 is presented below:  What amount should be recorded in Prepaid/Accrued Pension Cost when recording the 2015 pension expense and funding at December 31, 2015?

What amount should be recorded in Prepaid/Accrued Pension Cost when recording the 2015 pension expense and funding at December 31, 2015?

A) $1,200

B) $48,000

C) $87,000

D) $94,800

Correct Answer:

Verified

Q40: A company's pension expense includes all of

Q41: Vested benefits are

A)estimated benefits

B)not contingent on future

Q41: Given the following information Q46: If a company uses the indirect method Q47: Exhibit 19-02 Q48: The Peanut Company has a defined benefit Q50: A company must fund its pension plan Q53: Disclosures for vested benefits Q54: The Pension Benefit Guaranty Corporation's purpose is Q57: Current GAAP requires that the net gain![]()

The Sophia Company adopted a defined

A)are not required

B)are related

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents