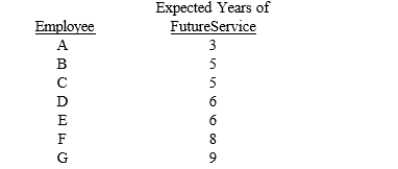

On January 1, 2015, a company had $84,000 of unrecognized prior service cost. The years-of-future-service method of amortization is used. The company has seven employees, as indicated below:  What amount of prior service cost should be included in pension expense for 2015?

What amount of prior service cost should be included in pension expense for 2015?

A) $2,000

B) $9,333

C) $12,000

D) $14,000

Correct Answer:

Verified

Q42: Which of the following statements is true?

A)Funding

Q43: ERISA (Pension Reform Act of 1974)provides guidance

Q50: A company must fund its pension plan

Q51: Exhibit 19-01

Marley Co. has an underfunded prepaid/accrued

Q52: Exhibit 19-01

Marley Co. has an underfunded prepaid/accrued

Q55: The expense for other postretirement benefits, such

Q56: GAAP requires that a company record a

Q59: Which of the following statements regarding postretirement

Q59: ACE has a defined benefit pension plan.

Q60: Which of the following items attributable to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents