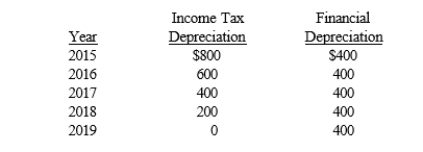

Pruett Corporation began operations in 2015 and appropriately recorded a deferred tax liability at the end of 2015 and 2016 based on the following depreciation temporary differences between pretax financial income and taxable income:  The income tax rate for 2015 and 2016 was 30%. In February 2017, due to budget constraints, Congress enacted an income tax rate of 35%. What is the journal entry required to adjust the Deferred Tax Liability account in February 2017?

The income tax rate for 2015 and 2016 was 30%. In February 2017, due to budget constraints, Congress enacted an income tax rate of 35%. What is the journal entry required to adjust the Deferred Tax Liability account in February 2017?

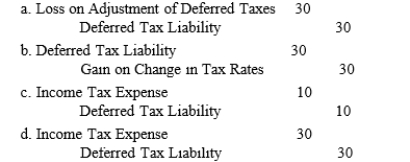

Correct Answer:

Verified

Q5: Which of the following transactions would typically

Q7: Each of the following can result in

Q15: When Congress changes the tax laws or

Q23: Differences between pretax financial accounting and taxable

Q24: A deferred tax asset would result if

A)

Q26: In 2016, its first year of operations,

Q27: Lewes Company appropriately uses the installment sales

Q30: During its first year of operations, 2016,

Q32: What three groups are measuring and timing

Q33: Differences between pretax financial income and taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents