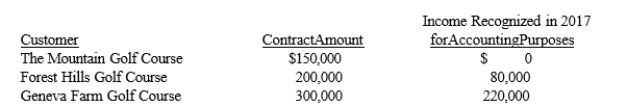

The Pink Diamonds Company installs fire alarm systems for large manufacturing enterprises and golf courses. Due to the design of their systems, some projects frequently extend over a two-year period. Pink Diamonds uses the percentage-of-completion method for financial accounting purposes and the completed-contract method for tax purposes. As of December 31, 2016, all projects were completed. The following information relates to projects started but not completed as of December 31, 2017:

Assuming an income tax rate of 30%, what amount should be included in the deferred tax liability account at December 31, 2017?

A) $70,000

B) $90,000

C) $105,000

D) $350,000

Correct Answer:

Verified

Q4: Interperiod income tax allocation is based on

Q26: Life insurance proceeds payable to a corporation

Q54: An operating loss carryforward occurs when

A)prior pretax

Q55: In 2016, the Puerto Rios Company received

Q58: In 2016, its first year of operations,

Q60: Shane Company uses an accelerated depreciation method

Q61: In applying intraperiod income tax allocation to

Q62: The Wyatt Company reports the following for

Q63: When accounting for the current impact of

Q64: Assuming there are no prior period adjustments

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents