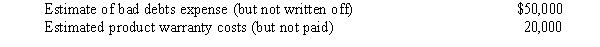

The Flintstone Company incurred the following expenses in 2016, which are reported differently for financial reporting purposes and taxable income:  If the tax rate is 40%, what is the total temporary difference?

If the tax rate is 40%, what is the total temporary difference?

A) $20,000

B) $28,000

C) $70,000

D) $150,000

Correct Answer:

Verified

Q8: Which of the following is not a

Q17: The amount owed the IRS is recorded

Q19: In accounting for income taxes, percentage depletion

Q30: All of the following involve a temporary

Q36: For the year ended December 31, 2016,

Q36: Interperiod tax allocation is required for all

Q38: Exhibit 18-1

On December 31, 2015, Fredericksburg, Inc.

Q40: As of December 31, 2016, the Williamsburg

Q42: Revenue from installment sales is recognized in

Q46: Which of the following would not result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents