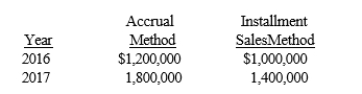

On January 1, 2016, Bedrock Company began recognizing revenues from all sales under the accrual method for financial reporting purposes and under the installment sales method for income tax purposes. Bedrock reported the following gross margin on sales for 2016 and 2017:  The enacted tax rate for both 2016 and 2017 was 30%. Assuming there are no other temporary differences, 2017 what is the amount of deferred tax liability that Bedrock should report on its December 31, 2017 balance sheet?

The enacted tax rate for both 2016 and 2017 was 30%. Assuming there are no other temporary differences, 2017 what is the amount of deferred tax liability that Bedrock should report on its December 31, 2017 balance sheet?

A) $60,000

B) $120,000

C) $180,000

D) $450,000

Correct Answer:

Verified

Q4: Interperiod income tax allocation is based on

Q21: All of the following involve a temporary

Q26: Life insurance proceeds payable to a corporation

Q29: Permanent differences impact

A)current deferred taxes

B)current tax liabilities

C)deferred

Q47: Which one of the following requires interperiod

Q49: Permanent differences between pretax financial income and

Q50: During its first year of operations ending

Q53: Which one of the following statements regarding

Q54: An operating loss carryforward occurs when

A)prior pretax

Q55: In 2016, the Puerto Rios Company received

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents