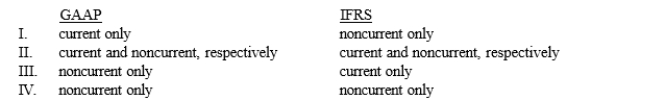

The acceptable balance sheet classifications for deferred tax assets and deferred tax liabilities under GAAP and IFRS are

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Q71: The presentation of the combination or "offsetting"

Q72: At the end of its first year

Q73: On December 31, 2015, Jefferson Lake, Inc.

Q74: Which of the following statements appropriately describe

Q75: Smyrna Company had financial and taxable incomes

Q77: Which one of the following would require

Q78: Intraperiod tax allocation would be appropriate for

Q79: The new presentation requirements for deferred tax

Q80: Beare Company claims a $2,000,000 R&D tax

Q81: Port Deposit, Inc. reports the following deferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents