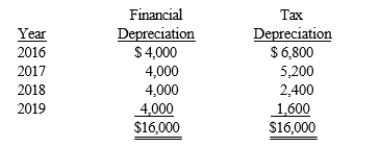

Fairfax Company had a balance in Deferred Tax Liability of $840 on December 31, 2016, resulting from depreciation timing differences. Differences in tax and accounting depreciation for assets purchased on January 1, 2016, are as follows:  In addition to the 2016 depreciation timing difference, Fairfax Company expensed $2,000 of warranty costs that will be deducted for tax purposes when paid in future years. Fairfax's taxable income in 2016 was $35,000. The 2016 income tax rate was 35%, and no changes in the tax rate for future years have been enacted.

In addition to the 2016 depreciation timing difference, Fairfax Company expensed $2,000 of warranty costs that will be deducted for tax purposes when paid in future years. Fairfax's taxable income in 2016 was $35,000. The 2016 income tax rate was 35%, and no changes in the tax rate for future years have been enacted.

Required:

Prepare the income tax journal entry for the Fairfax Company for December 31, 2016.

Correct Answer:

Verified

Q90: At the end of its first year

Q91: Delmarva Company, during its first year of

Q92: Rice, Inc. began operations on January 1,

Q93: Thorn Corporation has deductible and taxable temporary

Q94: The following information relates to the Kill

Q96: At the end of the current year,

Q97: At December 31, 2016, the Blue Agave

Q98: On December 31, 2016, the Town Hall

Q99: James Company reports the following information related

Q100: Jefferson Corporation reported the following pretax and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents