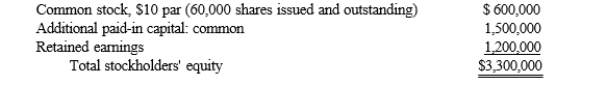

The Norman Corporation's stockholders' equity accounts have the following balances as of January 1, 2016:

Norman engaged in the following dividend transactions during 2016:

March 1: Declared a 50% stock dividend on the common stock, distributable on April 10.

The market price per share for the common stock was $35 on March 1.

April 10: Distributed the stock dividend declared on March 1.

June 30: Declared a 10% stock dividend on the common stock, distributable on August 5.

The market price for the common stock was $38 per share on June 30.

August 5: Distributed the stock dividend declared on June 30.

December 1: A $.60 per share cash dividend was declared on the common stock, payable on

January 20, 2017.

Required:

Prepare the entries to record the dividend transactions for 2016. Do not record the cash dividend payment in 2017.)

Correct Answer:

Verified

Q89: Why might prior period adjustment become necessary

Q90: List 4 factors that management may consider

Q91: Other Comprehensive Income or loss might include

Q92: On January 1, 2016, Jerry Co. had

Q93: Major Corporation had 50,000 shares of common

Q95: Graham, Inc. began 2017 with 25,000 common

Q96: List the 5 types of dividends.

Q97: What three items rarely affect retained earnings?

Q98: During an audit of Madison Company's December

Q99: During 2016, Sanders, Inc. had the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents