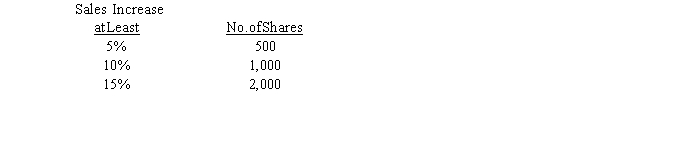

On January 1, 2016, Nelson Company gave 45 executives a performance-based stock option plan that allowed them to buy a maximum of 2,000 shares each of the company's $5 par common stock at $15 a share. On the grant date, the fair value per option was $8. The shares will be awarded based on the increase in sales over a four-year service and vesting period as follows:

The company estimates sales will increase by 8% during the service period and that the annual employee turnover rate will be 4%. During 2018, the estimated annual employee turnover rate was changed to 3% for the entire service period. At the end of the four-year period, options vested for the remaining 40 executives and sales actually

increased by 12%.

Required:

Prepare the journal entries to reflect the events affecting Nelson's plan for the four-year service period.

Correct Answer:

Verified

Q125: On January 1, 2016 Howard Corporation issued

Q126: On January 1, 2016, Microprocessing Inc. awarded

Q127: A partial listing of accounts and ending

Q128: Define the following terms:

Treasury Stock Authorized capital

Q129: What rights is a shareholder of capital

Q131: Advance Medical Imaging, Inc. reacquired 2,000 shares

Q132: Several years ago, Walther, Inc. issued 12,000

Q133: Below is the partial trial balance dated

Q134: On January 3, 2016, Maris Corporation issued

Q135: Trevor had outstanding 40,000 shares of $30

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents