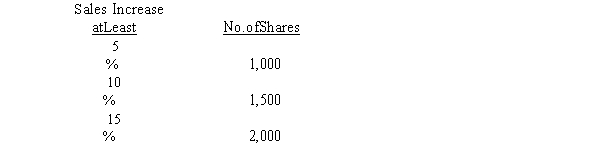

On January 1, 2016, Asquith Company adopts a performance-based stock option plan with a four-year vesting and service period, a $35 exercise price, and a $6 per option fair value. The plan grants a maximum of 2,000 shares of $5 par common stock to each of the company's 30 executives. The number of shares that vest depends on the increase in sales during the service period, based on the following scale:  Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan 2016 through 2020).

Correct Answer:

Verified

Mem...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Advance Medical Imaging, Inc. reacquired 2,000 shares

Q132: Several years ago, Walther, Inc. issued 12,000

Q133: Below is the partial trial balance dated

Q134: On January 3, 2016, Maris Corporation issued

Q135: Trevor had outstanding 40,000 shares of $30

Q137: Provide the definitions for the following terms:

Q138: Baltimore Bike had outstanding 12,000 shares of

Q139: On January 1, 2016, the Jim Corporation

Q140: On January 1, 2016, Robertson Company created

Q141: What characteristics may be specified in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents