On May 1, 2014, a $300,000, ten-year, 14% bond was sold to yield 12% plus accrued interest. The bond was dated

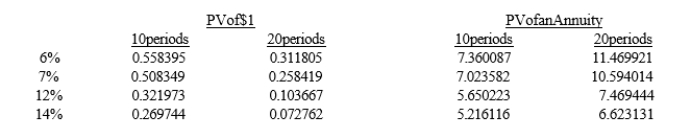

January 1, 2014, and interest is paid each January 1 and July 1. Present value data follow:  Required:

Required:

a. Compute the amount of cash received from the sale of the bond.

b. Prepare the journal entry to record the sale.

c. When preparing the journal entry, you recorded a premium or discount. Discuss why.

Correct Answer:

Verified

b.

c. The market rate ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q73: The portion of proceeds from the sale

Q109: In a troubled debt restructuring that involves

Q120: Related to long-term liabilities, reading the notes

Q137: Exhibit 14-16

Harry's Inc. issued a four-year, $75,000,

Q138: Exhibit 14-13

Yoho Corp. issued $500,000 of its

Q139: On January 1, 2013, Angle Products issued

Q140: Fair market values of the common stock

Q142: Which of the following is true for

Q144: Sharon owes Lawrence Co. $15,000 on a

Q146: On January 1, 2016, the Q-Ball Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents