Exhibit 13-03

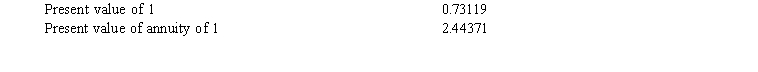

On January 1, 2017, Train, Inc. accepted an $80,000, non-interest bearing 3 year note in exchange for equipment it sold to Steam Company. Train originally purchased the equipment for $125,000, and it had a book value of $75,000 on the date of the sale. The note was non-interest-bearing. An assumed 11% interest rate is implicit in the agreement. Actual information for 11%, three periods, follows:

-Refer to Exhibit 13-03. What amount would Train record as interest income on December 31, 2017?

A) $6,434

B) $8,800

C) $2,366

D) $0

Correct Answer:

Verified

Q68: An interest rate swap in which a

Q71: The cash surrender value of the insurance

Q86: The journal entry to recognize the impairment

Q89: On January 1, 2017, Lightner bought 20,000

Q90: On January 2, 2017, Mark Company acquired,

Q92: In a matched swap, the actual loan

Q92: On January 1, 2017, Waters Corp. bought

Q93: On July 1, Sleepy, Inc. purchased 100

Q94: A derivative may be classified as:

A) an

Q95: Exhibit 13-03

On January 1, 2017, Train, Inc.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents