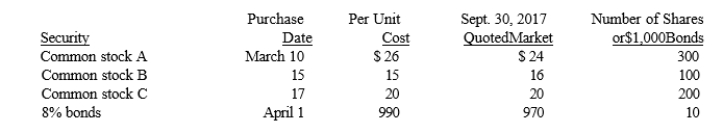

In 2017, Bucky Corporation, for the first time, invested some idle funds in a variety of securities classified as trading, as described below:

The company's year ends on December 31 and the bonds pay interest semiannually on January 1 and July 1.

Required:

Answer each of the following questions about Bucky Corporation's investments:

a. Calculate the amount of the unrealized holding gain/loss for the securities in the portfolio at the end of the third quarter, and indicate whether the balance would indicate an unrealized gain or an unrealized loss.

b. What was the amount of the discount or premium involved in the company's purchase of the bonds?

c. Ignoring amortization, how much did Bucky record as Interest Income on the bond investment during the third quarter of 2017?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: First Bank purchased the following securities during

Q106: At December 31, 2017, Isotope Co. held

Q107: On January 1, 2017, A Corp. had

Q108: On January 1, 2017, the Z Corporation

Q109: On January 1, 2017, Garcia Company acquired

Q111: During January 2017, Long Corporation for the

Q112: On January 1, 2017 Chase sold land

Q113: Ringer Company acquired 40% of the outstanding

Q114: On January 3, 2017, Nancy Corporation purchased

Q115: On January 1, 2017, the Widner Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents