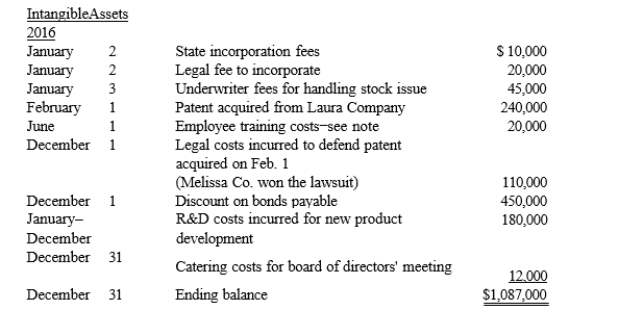

Melissa Company, which was organized in January 2016, recorded the following transactions during 2014 in a single account called Intangible Assets:  Note: The president of Melissa has stated that she believes the employee training costs have resulted in goodwill.

Note: The president of Melissa has stated that she believes the employee training costs have resulted in goodwill.

Required:

a. Prepare an entry as of December 31, 2016, to reclassify the items from the intangible assets account to the appropriate accounts.

a. Patents are estimated to have a ten-year economic life. Any other intangible assets recognized should be amortized over their legal life. Record amortization to the nearest month, using the straight-line method.

b. Prepare the adjusting entry or entries required to amortize any intangible assets recorded or remaining from requirement

Correct Answer:

Verified

Q71: The determination of impairment losses differs under

Q96: On January 1, 2015, Moose Co. purchased

Q97: Development costs related to computer software that

Q98: Development costs related to computer software that

Q100: Which statement about negative goodwill is true?

A)

Q102: Boggs Company is looking to purchase the

Q103: Grier purchased Walters Company several years ago.

Q104: What factors should a company consider when

Q105: Costs associated with various intangibles of a

Q106: The CMS Co. began operations in January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents