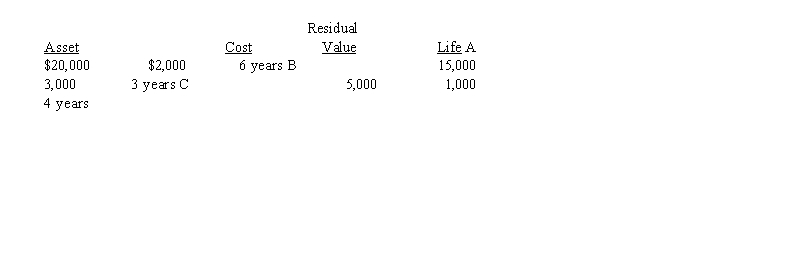

On January 1, 2016, Mullhausen Co. began using the composite depreciation method. There were three machines to consider, as follows:  At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

At the end of the second year, Machine B was sold for $8,200. In the entry to record the sale, there should be a

A) $1,200 debit to Gain on Sale of Machine

B) $6,800 debit to Accumulated Depreciation

C) $6,800 debit to Loss on Sale of Machine

D) $8,000 debit to Accumulated Depreciation

Correct Answer:

Verified

Q30: Which one of the following statements is

Q34: Which one of the following statements is

Q35: Which one of the following statements is

Q39: Which one of the following statements is

Q40: Exhibit 11-1

On January 1, Year 1, Hills

Q41: Lucas, Inc. purchased ten air conditioning units

Q42: On January 1, 2016, Flo, Inc. purchased

Q47: A company purchased ten delivery vehicles at

Q49: Five skid steers costing $20,000 each were

Q58: Which one of the following statements about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents