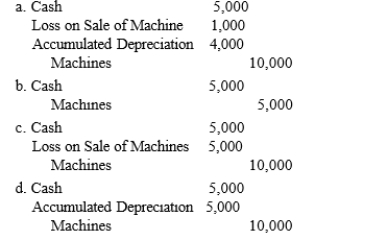

On January 1, 2015, Morgantown Co. purchased five machines at a price of $10,000 per machine. Because the estimated life was five years and no salvage value was expected, a group depreciation rate of 20% was used. On January 1, 2017, one of the machines was sold for $5,000. The correct entry to record the sale of the machine is

Correct Answer:

Verified

Q24: Which one of the following statements is

Q32: A student is defending a certain depreciation

Q35: Which one of the following statements is

Q36: What effect does depreciation have on the

Q38: Which one of the following disclosures is

Q51: Willis Limo Service purchased three used assets

Q52: Which of the following is not a

Q54: What was the cost of the asset?

A)

Q56: Mark Industries uses the straight-line depreciation method.

Q57: The Cardwell Company purchased a machine on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents