Green Vegetable Mfg. Co. purchased equipment on January 1, 2016, at a cost of $800,000. The equipment is expected to have a service life of ten years, or 40,000 hours, and a residual value of $70,000. During 2016, the equipment was operated for 5,000 hours, and during 2017, it was operated for 7,000 hours.

Required:

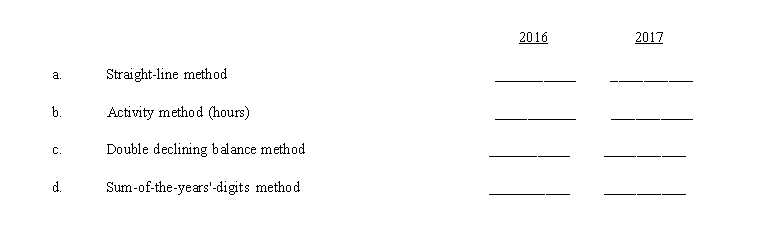

Fill in the blanks below with the depreciation expense to the nearest whole dollar) for this machine in 2016 and 2017 under each of the following depreciation methods:

Correct Answer:

Verified

2 [$800,000 − ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: On January 1, 2016, Check Co. bought

Q110: On April 20, 2016, Maskell Co. purchased

Q111: Peanut Company purchased a machine on January

Q112: On January 2, 2016, China Co. bought

Q113: Jonas Company purchased a photocopier that cost

Q115: On January 1, 2016, Paradise Hotels and

Q116: On January 1, 2015, the Jones-Smith Corp.

Q117: On January 1, 2016, Major purchased a

Q118: On January 1, 2016, World Inc. purchased

Q119: The Roberto Company purchased a limo for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents