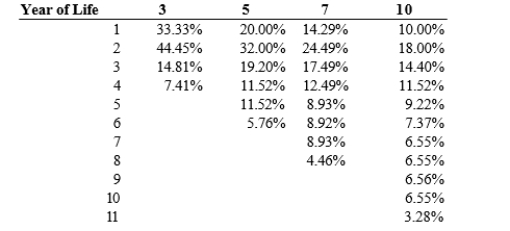

On January 1, 2015, Smith-Jones Company purchased office furniture for $80,000. Other data on the purchase include the following:  The MACRS Depreciation table is as follows:

The MACRS Depreciation table is as follows:

MACRS Depreciation as a Percentage of the Cost of the Asset  Required:

Required:

a. Compute the depreciation deduction for the 2015 tax return.

b. Assume the asset is sold on April 1, 2023 for $3,000. Compute the gain/loss on disposal for both financial reporting and tax reporting.

Correct Answer:

Verified

Q89: The straight-line and accelerated depreciation methods differ

Q96: It has been suggested that repair and

Q125: What disclosures are required by GAAP for

Q126: List the time based methods of cost

Q127: Assets from time to time become impaired.

Q128: What costs can be capitalized as part

Q130: In 2015, the Hermes Corporation failed to

Q132: Information concerning a mine is as follows:

Q133: What four factors must be considered in

Q134: Making intercompany comparisons is equally as important

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents