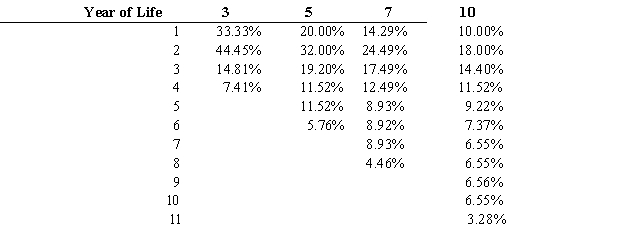

The MACRS Depreciation table is as follows:

MACRS Depreciation as a Percentage of the Cost of the Asset  Required:

Required:

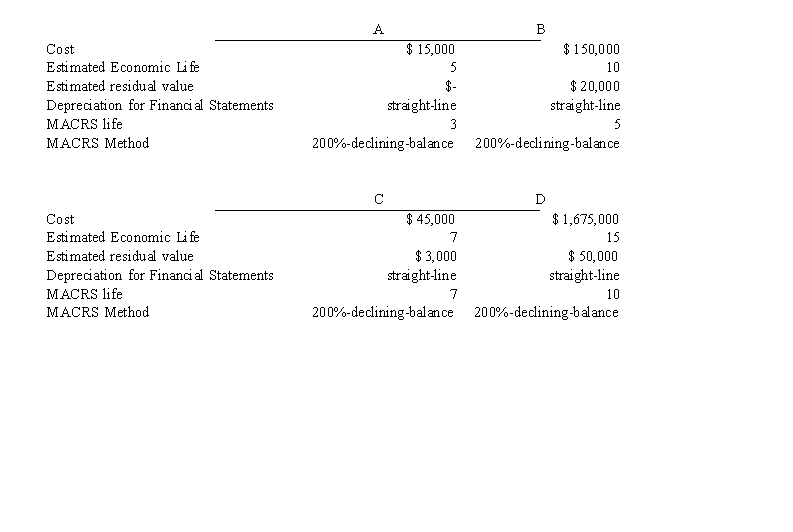

Using the MACRS Depreciation table calculate each year of depreciation for each independent situation.

Correct Answer:

Verified

Q89: The straight-line and accelerated depreciation methods differ

Q101: Generally, IFRS require asset impairments to be

Q118: On January 1, 2016, World Inc. purchased

Q119: The Roberto Company purchased a limo for

Q120: The Jefferson Co. purchased a machine on

Q122: Companies can apply composite depreciation to a

Q125: What disclosures are required by GAAP for

Q126: List the time based methods of cost

Q127: Assets from time to time become impaired.

Q128: What costs can be capitalized as part

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents