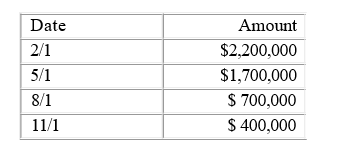

On January 1, 2016, Olvert Corp. signed a contract to have Bob's Builders construct a distribution center at a cost of $10,000,000. It was estimated that it would take two years to complete the project. Also on January 1, 2017, to finance the construction cost, Tolvin borrowed $10,000,000 payable in five annual installments of $4,000,000 plus interest at the rate of 6%. During 2017, Tolvin made the following construction-related expenditures:

What amount should Tolvin report as capitalized interest at December 31, 2017?

A) $621,000

B) $300,000

C) $207,000

D) $150,000

Correct Answer:

Verified

Q42: Which of the following events is most

Q53: According to GAAP, interest cost incurred to

Q60: Richards, Inc. exchanged a piece of equipment

Q61: The Nathan Jacob's Company paid $450,000 to

Q62: Two alternative methods of accounting for the

Q67: On January 1, 2011, Barton Sinks purchased

Q68: The costs of drilling an unsuccessful well

Q69: On January 1, 2017, Tolvin Company signed

Q70: In 2016, Go Oil Company incurred costs

Q73: Concerning current accounting for oil and gas

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents