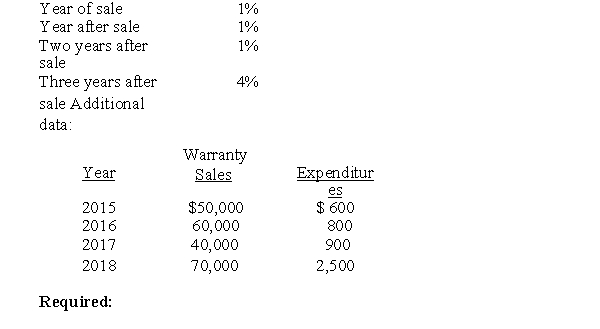

Munster sells a product with a four-year warranty. Warranty costs are estimated as a percentage of sales as follows:

a. If this is an assurance-type warranty and the company uses the modified cash method, what would be warranty expense for 2017?

b. If this is an assurance-type warranty and and the company uses the GAAP approach of accruing warranty expense and the related liability) in the year of the sale, what would be warranty expense for 2017?

c. If the company considers that 7% of the selling price of the produce represents payment for an implied service-type warranty, what amount of unearned warranty revenue would be disclosed on the balance sheet on December 31, 2018?

Correct Answer:

Verified

b. .07 × $40...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Under what conditions can a short-term obligation

Q100: On January 1, 2015, Peg, Inc. bought

Q101: Conceptually, how should current liabilities be valued?

Q102: The following information is given for Airflight

Q103: Listed below are several types of contingencies

Q104: The sales manager of the Walbrook Company

Q106: List five examples of liabilities that are

Q108: What are the FASB's broad guidelines for

Q109: List five examples of liabilities whose amounts

Q110: List five examples of liabilities whose amounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents