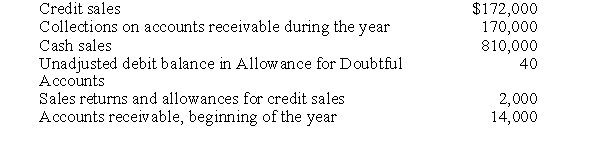

Based on the following information:  If expected bad debts are estimated to be 1 1/2% of ending accounts receivable, the adjusting entry to recognize bad debts will include a debit to Bad Debt Expense for

If expected bad debts are estimated to be 1 1/2% of ending accounts receivable, the adjusting entry to recognize bad debts will include a debit to Bad Debt Expense for

A) $170

B) $190

C) $210

D) $250

Correct Answer:

Verified

Q48: When accounting for uncollectible accounts,

A)if the percentage

Q66: Under the allowance method of recording bad

Q67: Which of the following methods is not

Q68: Based on the following information:

Q69: Splitter Corporation had total sales in the

Q70: During 2016, a company wrote off $7,500

Q72: When aging of accounts receivable is used,

Q73: An advantage of basing bad debt expense

Q74: Pineapple's Fruit Smoothies began the year with

Q76: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents